Securing Virtual Health: Necessity of Telemedicine Fraud Insurance

The rapid rise of telemedicine has brought unprecedented convenience to healthcare access. However, with this convenience comes the potential for telemedicine fraud, necessitating the development of specialized insurance solutions to safeguard against financial risks and uphold the integrity of virtual health services.

Understanding the Telemedicine Landscape

Telemedicine has emerged as a transformative force in healthcare, enabling patients to connect with healthcare professionals remotely. This paradigm shift, accelerated by technological advancements, has proven invaluable, especially in times of global health crises. However, the virtual nature of telemedicine introduces unique challenges, including the risk of fraudulent activities.

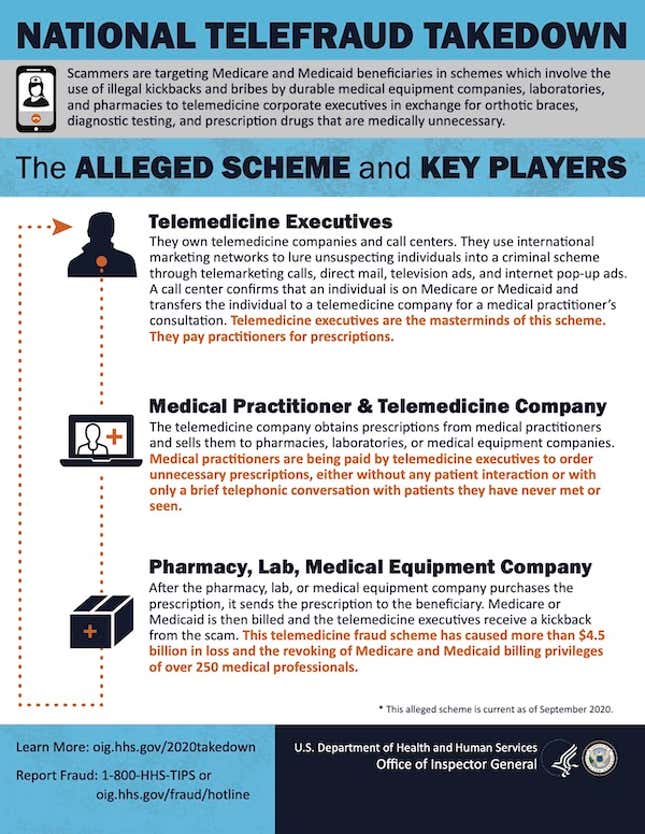

The Growing Threat of Telemedicine Fraud

As telemedicine gains popularity, so does the threat of fraudulent activities targeting virtual healthcare systems. From identity theft to falsified medical claims, the vulnerabilities of telemedicine platforms are increasingly exploited by fraudsters. This raises concerns about the financial impact on healthcare providers and insurers, highlighting the need for proactive risk management strategies.

Telemedicine Fraud Insurance: An Essential Safeguard

Recognizing the escalating threat of telemedicine fraud, insurance providers now offer specialized coverage – Telemedicine Fraud Insurance. This insurance serves as a crucial safeguard, offering financial protection against losses resulting from fraudulent activities within the telemedicine space. As the industry evolves, so do the offerings of Telemedicine Fraud Insurance, tailored to address emerging risks.

Coverage Scope and Protection Measures

Telemedicine Fraud Insurance typically covers a range of scenarios, including identity theft, fraudulent billing, and cyber attacks on telehealth platforms. The coverage scope may vary, and stakeholders must carefully assess their insurance policies to ensure comprehensive protection. In addition to insurance, implementing robust cybersecurity measures and identity verification protocols is essential to fortify telemedicine against fraud.

Mitigating Financial Risks for Healthcare Providers

Healthcare providers are at the forefront of telemedicine services, and they face substantial financial risks in the event of fraud. Telemedicine Fraud Insurance provides a safety net, mitigating the financial impact of fraudulent activities on healthcare practices. This allows providers to focus on delivering quality care without the constant fear of financial repercussions.

Consumer Trust and Telemedicine Fraud Prevention

Maintaining consumer trust is paramount for the success of telemedicine. Insurance against fraud plays a pivotal role in ensuring that patients feel secure when engaging in virtual healthcare services. Telemedicine Fraud Insurance contributes to building and preserving this trust by actively addressing and mitigating the risks associated with fraudulent activities.

Adapting to Evolving Telemedicine Threats

As technology advances, so do the tactics of fraudsters. Telemedicine Fraud Insurance must adapt to evolving threats to remain effective. Insurers continuously refine and expand their coverage offerings to address emerging risks and vulnerabilities, ensuring that healthcare providers and stakeholders are well-protected in this dynamic landscape.

Collaboration for Industry Standards

Creating industry standards and best practices is a collaborative effort involving insurers, healthcare providers, and regulatory bodies. Establishing clear guidelines for telemedicine security and fraud prevention contributes to the overall resilience of the virtual healthcare ecosystem. Telemedicine Fraud Insurance aligns with these standards, providing a layer of financial protection that complements proactive prevention measures.

The Future of Telemedicine Fraud Insurance

As telemedicine continues to evolve, so will the landscape of fraud risks. Telemedicine Fraud Insurance is poised to play an increasingly vital role in the future of virtual healthcare. Insurers will likely refine their offerings to meet the changing needs of the industry, ensuring that telemedicine remains a trusted and secure avenue for delivering healthcare services.

To learn more about Telemedicine Fraud Insurance and how it addresses the unique risks associated with virtual healthcare, visit Telemedicine Fraud Insurance for comprehensive information and solutions.