Securing Virtual Identities: Exploring Digital Identity Theft Insurance Services

In an era dominated by digital interactions, the risk of identity theft looms large. As cyber threats escalate, the need for robust protection becomes paramount. This article delves into the realm of Digital Identity Theft Insurance Services, examining how these solutions offer a safeguard against the evolving landscape of cyber threats.

Understanding the Digital Identity Landscape: The Pervasiveness of Cyber Threats

The digital age has brought unparalleled convenience but also heightened vulnerability. Cybercriminals constantly evolve their tactics, targeting personal information for financial gain. Digital identities, encompassing a myriad of online activities, are prime targets. Understanding the pervasive nature of cyber threats is the first step in recognizing the crucial role of Digital Identity Theft Insurance Services.

Comprehensive Coverage for the Digital Persona: Addressing Varied Threats

Digital Identity Theft Insurance Services go beyond traditional coverage by addressing the diverse threats faced in the virtual realm. From financial fraud and phishing attacks to social engineering schemes, these services offer comprehensive coverage, mitigating the potential fallout of identity theft. This breadth of protection ensures that policyholders are shielded from an array of cyber threats.

Financial Reimbursement and Recovery Assistance: Restoring Stability

In the aftermath of identity theft, the financial repercussions can be severe. Digital Identity Theft Insurance Services provide financial reimbursement for losses incurred due to fraudulent activities. Additionally, these services offer recovery assistance, guiding individuals through the process of reclaiming their digital identities and restoring financial stability after an identity theft incident.

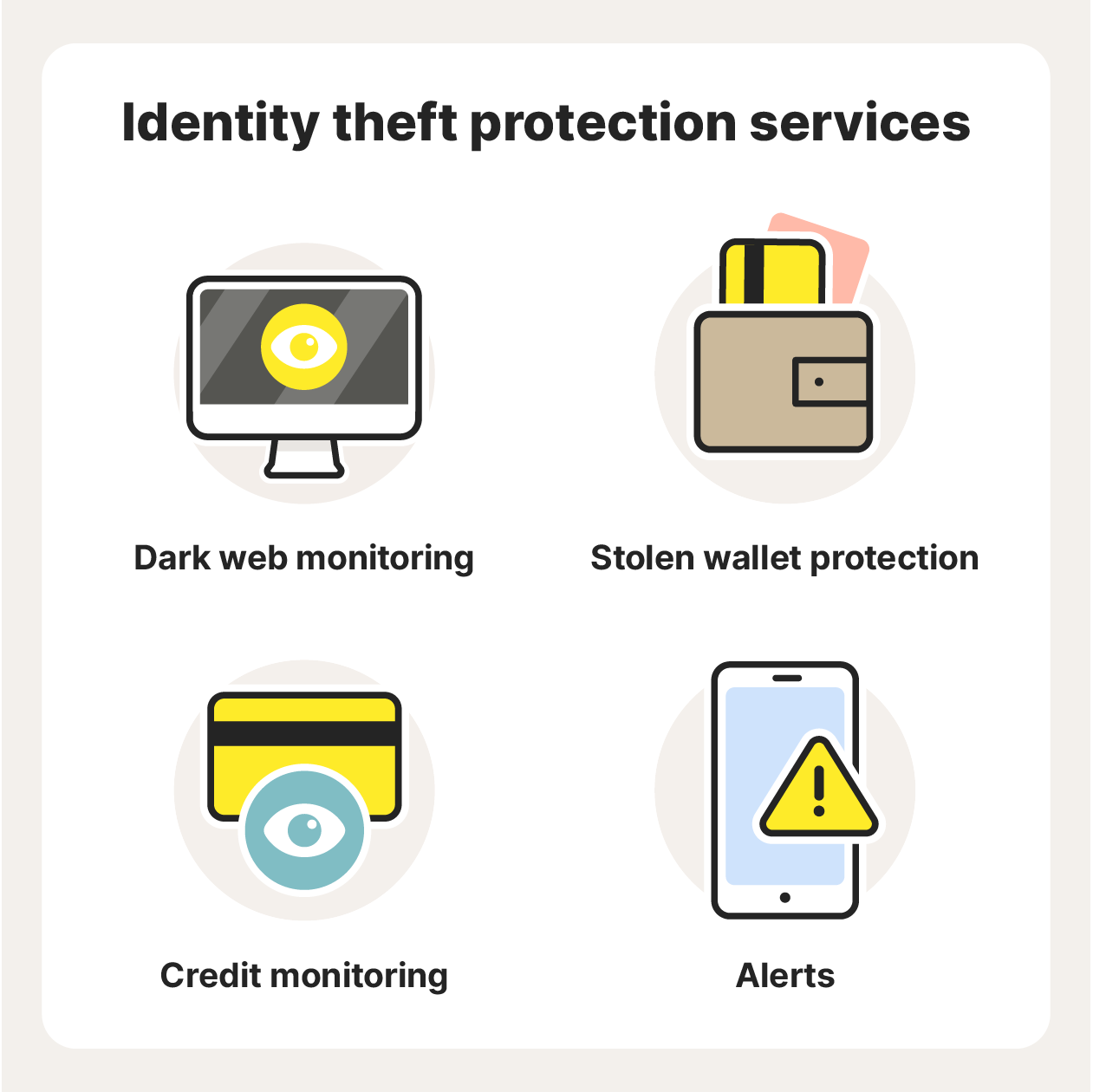

Monitoring and Alerts: Proactive Defense Mechanisms

Prevention is often the best defense against identity theft. Digital Identity Theft Insurance Services incorporate monitoring and alert systems that proactively track potential threats. Whether it’s monitoring credit reports, dark web scans, or tracking unusual online activities, these services deploy sophisticated algorithms to detect signs of identity theft, allowing for swift action to mitigate risks.

Educational Resources: Empowering Policyholders with Knowledge

Cyber threats are dynamic, and staying informed is crucial. Digital Identity Theft Insurance Services offer educational resources to policyholders, empowering them with the knowledge to recognize and avoid potential threats. This proactive approach enhances policyholders’ digital literacy, reducing the likelihood of falling victim to common identity theft tactics.

Legal Support and Identity Restoration: Navigating Post-Theft Challenges

Identity theft often involves complex legal challenges. Digital Identity Theft Insurance Services provide legal support to navigate the intricacies of resolving identity theft cases. Additionally, these services assist in the process of identity restoration, helping individuals reclaim their digital lives and rectify the damages caused by fraudulent activities.

To learn more about the protective features of Digital Identity Theft Insurance Services, click here. This link offers a deeper understanding of how these services can safeguard against evolving cyber threats, providing insights into the advanced measures taken to protect digital identities.

Conclusion: Fortifying Digital Lives in an Uncertain World

In conclusion, Digital Identity Theft Insurance Services play a pivotal role in fortifying digital lives in an era fraught with cyber threats. As individuals navigate the virtual landscape, the comprehensive coverage, proactive defense mechanisms, and support services offered by these insurance solutions become indispensable. The evolution of these services reflects a commitment to ensuring that individuals can embrace the digital age with confidence, knowing that their digital identities are safeguarded against the ever-present risks of identity theft.