Introduction:

In an era where environmental consciousness is on the rise, businesses and individuals alike are seeking sustainable solutions. Circular Economy Insurance Programs emerge as a crucial aspect in this paradigm shift, offering coverage that aligns with eco-friendly practices.

The Essence of Circular Economy Insurance:

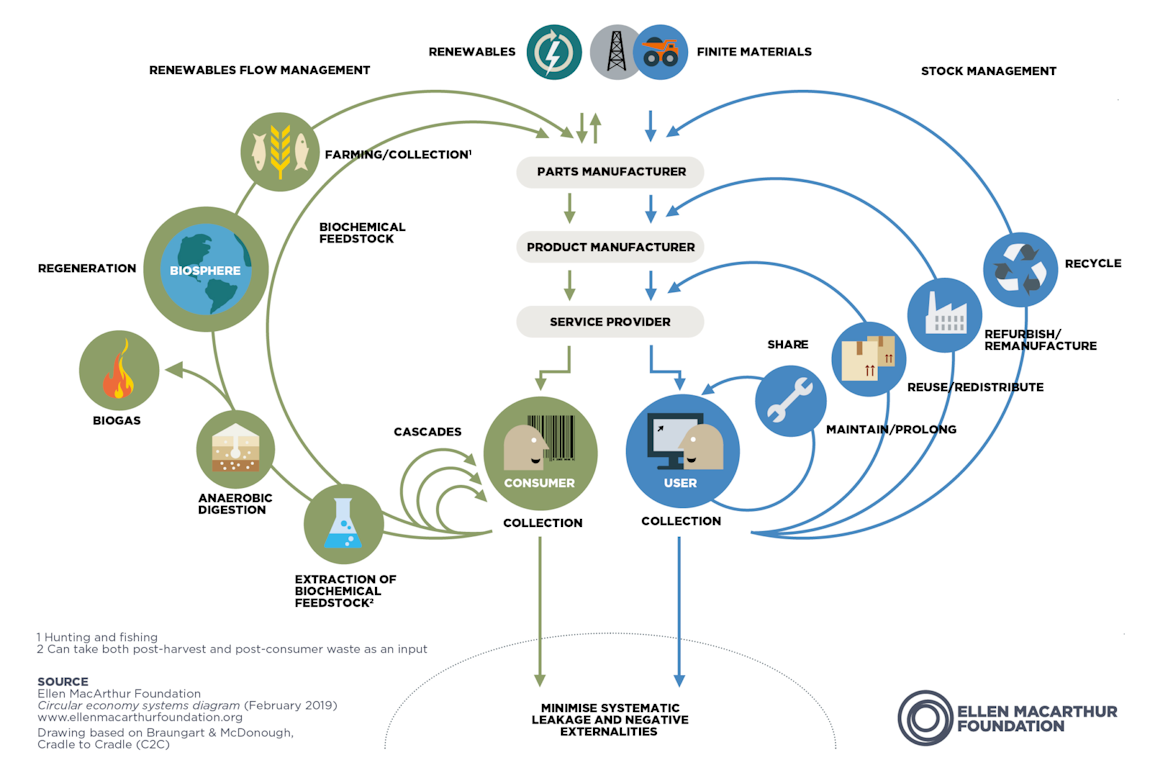

Circular Economy Insurance Programs are designed to support businesses adopting circular economy principles. These insurance policies go beyond traditional coverage, incentivizing and protecting companies committed to sustainable practices.

Coverage Tailored to Circular Practices:

Unlike conventional insurance, Circular Economy Insurance Programs are crafted to align with the unique needs of businesses embracing circularity. From sustainable supply chain management to waste reduction strategies, these programs provide comprehensive coverage tailored to environmentally responsible practices.

Risk Mitigation in the Circular Loop:

Circular economy initiatives often involve innovative approaches, introducing new risks. Circular Economy Insurance acts as a safeguard, mitigating risks associated with transitioning to circular business models. This includes coverage for potential disruptions in supply chains, fluctuating raw material prices, and other challenges unique to circular practices.

Encouraging Sustainable Innovation:

Circular Economy Insurance Programs not only protect against risks but also encourage sustainable innovation. By providing financial security, these programs empower businesses to invest in eco-friendly technologies, product redesign, and other initiatives that contribute to the circular economy.

Collaborative Partnerships for a Circular Future:

Insurers, businesses, and policymakers can collaborate to create an ecosystem that fosters circularity. Circular Economy Insurance Programs serve as a bridge, bringing together stakeholders committed to building a sustainable future. This collaborative approach ensures a holistic and effective transition to circular business models.

Real-Life Examples of Circular Economy Success:

To illustrate the impact of Circular Economy Insurance Programs, we can look at real-life success stories. Companies that have embraced circular practices and benefited from these insurance programs demonstrate the tangible advantages of integrating sustainability into their business models.

Navigating Challenges with Circular Economy Insurance:

Transitioning to a circular economy is not without challenges. Circular Economy Insurance Programs address these challenges head-on, providing support during the implementation phase and helping businesses overcome obstacles on their journey towards sustainability.

The Role of Technology in Circular Insurance:

Technology plays a pivotal role in the success of Circular Economy Insurance Programs. From data analytics for risk assessment to blockchain for transparent supply chains, technological advancements enhance the efficiency and effectiveness of these insurance solutions.

Linking to a Circular Future:

In the midst of these transformative changes, it is crucial to highlight the role of Circular Economy Insurance Programs in shaping a sustainable future. Businesses can explore these innovative insurance options to not only protect their interests but also contribute to a global shift towards circular practices. To learn more about Circular Economy Insurance Programs, visit Circular Economy Insurance Programs.

Conclusion:

Circular Economy Insurance Programs represent a pivotal step towards creating a business landscape that aligns with the principles of sustainability. As businesses increasingly recognize the importance of circular practices, these insurance programs provide a safety net, encouraging innovation and collaboration. By linking insurance solutions with the circular economy, we pave the way for a more resilient and sustainable future.