Unlocking the Benefits of a Car Insurance Broker: Your Trusted Ally in Coverage

In the complex world of insurance, having a knowledgeable ally can make all the difference. A car insurance broker steps into this role, offering tailored solutions and expertise to navigate the intricacies of coverage.

Understanding the Broker Advantage

Unlike dealing directly with insurance companies, a car insurance broker acts as an intermediary between you and insurers. Their expertise lies in assessing your unique needs and finding the most suitable coverage from a range of insurance providers. It’s like having a personal shopper for your insurance needs.

Tailored Solutions for Your Unique Needs

One of the key advantages of working with a car insurance broker is the personalized approach to coverage. They take the time to understand your driving habits, lifestyle, and specific requirements. This in-depth knowledge allows them to recommend policies that align with your individual needs, ensuring you get the coverage that matters most to you.

Access to a Diverse Range of Policies

Car insurance brokers have an extensive network of insurance providers at their fingertips. This means they can present you with a variety of policy options from different companies. This diversity allows you to compare not only prices but also the specific features and benefits of each policy, empowering you to make an informed decision.

Cost-Effective Solutions and Discounts

Contrary to common belief, utilizing a car insurance broker doesn’t necessarily mean higher costs. In many cases, brokers can negotiate competitive rates on your behalf. Additionally, they are often privy to discounts and promotions that may not be readily available to the general public. This can result in cost-effective solutions that align with your budget.

The Middleman Advantage: Claim Assistance

When it comes to filing claims, having a car insurance broker on your side can be immensely beneficial. They act as a liaison between you and the insurance company, streamlining the claims process. This can save you time and alleviate the stress associated with navigating claims procedures on your own.

Link to Car Insurance Broker: Your Personal Insurance Guide

Amidst the myriad of insurance options, a car insurance broker emerges as a valuable guide. If you’re ready to explore personalized coverage solutions tailored to your needs, consider the expertise of a car insurance broker. Visit Car Insurance Broker to discover how they can be your personal insurance ally.

Navigating Specialized Coverage Needs

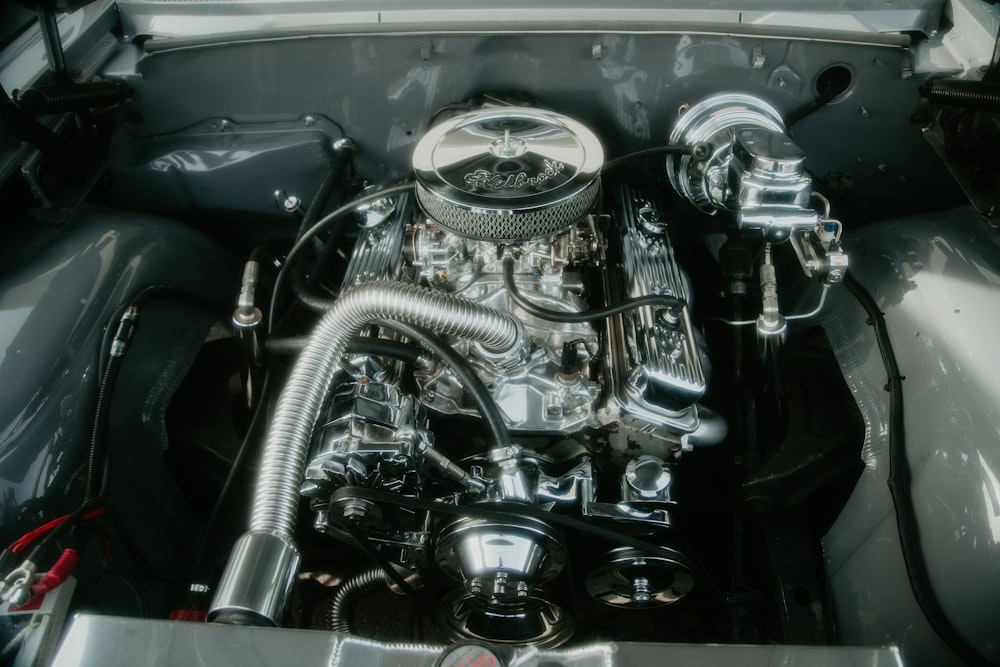

Whether you have a unique vehicle, special modifications, or specific coverage requirements, a car insurance broker can help. They specialize in navigating the complexities of unique coverage needs, ensuring that you have the right protection for your one-of-a-kind situation. It’s about addressing the nuances that make your insurance needs distinct.

Ongoing Support and Policy Adjustments

Life changes, and so do your insurance needs. A car insurance broker provides ongoing support, assisting you with policy adjustments as your circumstances evolve. This could include adding a new driver, changing vehicles, or relocating. With a broker, you have a continuous resource for keeping your coverage up-to-date.

Advocacy in Your Best Interest

Unlike an insurance agent who works for a specific company, a car insurance broker works for you. Their allegiance is to your best interest, and they advocate on your behalf. This can be especially valuable in situations where there may be disputes or issues with claims. Your broker is there to ensure your concerns are heard and addressed.

Empower Your Insurance Journey with a Car Insurance Broker

In the realm of insurance, having a trusted ally can make all the difference. A car insurance broker empowers you to make informed decisions, find cost-effective solutions, and navigate the complexities of coverage with ease. Unlock the benefits of a personal insurance guide and embark on a journey of tailored protection with a car insurance broker.